Market and industry research is crucial for business success in 2024. Knowing your market, demographic, and competitors is a quick recipe for triumph when crafting your own growth strategy.

In fact, companies that embrace customer-centric market research are deemed 60% more profitable than businesses that skip the research stage.

💡 Read Consumer Behavior Analysis 101: How to Learn More About Your Customers

“While working on your market analysis and industry analysis can seem like a lot of work, it’s work that will pay for itself many times over once you start your business,” says Noah Parsons, COO at Palo Alto Software. “Having a deep knowledge of how your industry works and how your target market behaves will help you develop smarter strategies for growth. Instead of just guessing or relying on hunches, you can make decisions that are backed up by real knowledge and increase your chances for success.”

So, where should you start when it comes to industry and market research? While both research strategies sound similar, they are both utilised for different use cases. Depending on what area of your business strategy you aim to improve, you may opt to perform an industry analysis, market analysis or both.

The question is, what is the difference, and how do you choose which research strategy is right for your company?

Stick with us as we delve into the definitions of industry research and market research and reveal three crucial differences between them.

Industry Research vs Market Research: What’s The Difference?

There are a number of factors that set industry research and market research apart. From target audience to key player analysis, one methodology teaches you more about your position within your industry, while one pours more focus into your target market and its customers.

Here are the definitions of both terms:

Industry Research

Industry research is the study of one’s industry, its processes and particular services. Many business owners use industry research to gain a better understanding of their place within the industry and to identify new opportunities and potential threats that could appear down the line.

Industry analysis enables a company to identify the real players within their industry and work towards certain industry trends to enhance company growth.

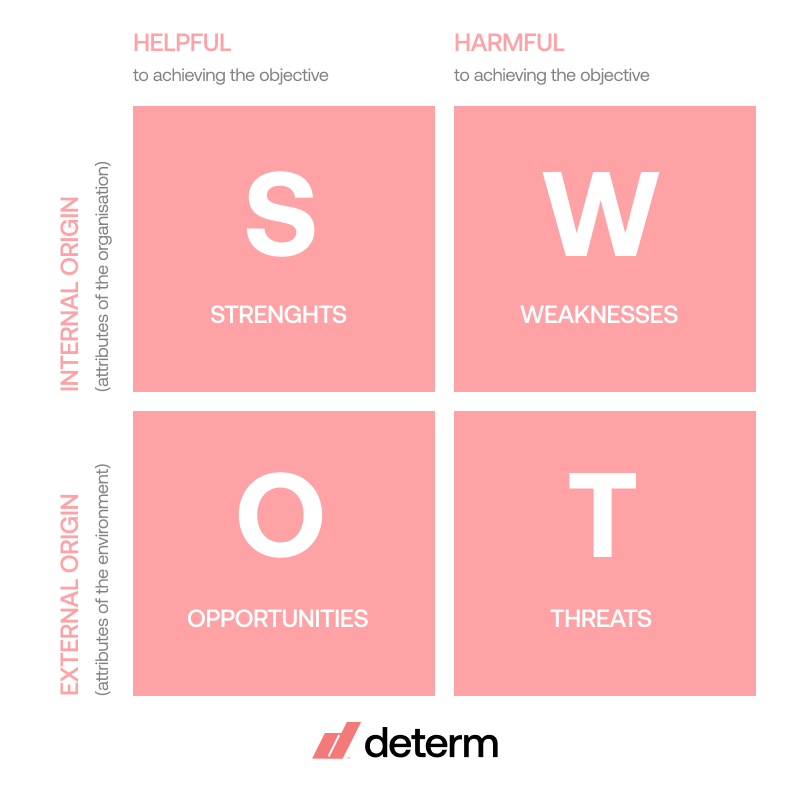

The most classic approaches to an industry research strategy are a SWOT analysis, a competitive forces model and a broad factors analysis.

These models of research help businesses identify strengths and weaknesses within their own processes, as well as help companies look at the bigger picture. Industry research looks further into all power forces, such as the economy, politics and anything outside of the industry that may affect its players, whereas market research delves deeper into the details.

Market Research

Unlike industry research, market research is less about competing forces but about the market and the customers you aim to serve.

Market research tells a business how they can improve their position within their industry by taking a deper dive into consumer metrics and trends. Market research analyses demographic behaviour, location, trends and direct competition to provide brands with data that can inform their next move.

The question market research asks is – who are your potential leads? What are their online shopping habits? Using methods such as market mapping and specific competitive analysis models, market research can help businesses improve their manufacturing, selling and marketing strategies.

Read How to Do Market Research With a Media Monitoring Tool

3 Ways Market and Industry Research Differ In 2024

Industry research and market research differ in a number of ways ranging from their target data to the key metrics used to complete a market or industry analysis.

If you’re still unsure about which research strategy to choose from, we’ve collated three of the most crucial differences that might help you make up your mind.

1. Target Group & Competition Analysis

Let’s first look at the alternative target audiences targeted by a market and industry analysis.

Industry Research:

Industry research focuses more on higher-level manufacturers and the way a business compares with its competitors. In an attempt to analyse the top products on the market and the processes behind a competitor’s success, an Industry analysis targets the largest factors influencing the industry in order to discover potential opportunities within the market and threats that could cause harm to the business.

When it comes to competition analysis, industry research focuses on how a competing business produces its products and generates new trends for a chance to get ahead and gain an advantage within the industry.

Market Research:

Market research focuses more heavily on a business’s buyers and sellers. Rather than targeting a competing business itself, a market analysis targets the company’s demographic and the consumer’s direct response to different trends, products and content. This makes it an excellent tool to enhance your PR strategy.

Competition analysis from a market research perspective comes in the form of a seller analysis. Focusing on how each seller competes to attract the buyer, a market research strategy aims to help companies increase their sale and engagement rate within a smaller group of niche competitors.

2. Key Metrics To Track

Both market research and Industry research have different key metrics. Let’s see which metrics fall under each analytic strategy.

Industry Research

Here are the key metrics to track when performing an industry analysis:

- Key competitors: An industry analysis should measure the success of key competitors and compare their growth data to yours. Using a competitor analysis tool such as the one from Determ, you can track all competitor news, media coverage and social media activities in one simple feed/platform.

- Industry growth: As a research strategy that looks at the industry as a whole, one of the most important metrics to track is the growth of your industry. This analyses whether your market is growing or shrinking.

- Trends: Industry research can be used to analyse and evaluate key trends in and out of your industry to provide a company with an insight into how each trend factors into the success or failure of a product or company direction.

Market Research

Here are the key metrics to track when performing a market analysis:

- Market demographic: The number one metric to track in a market analysis is your market demographic. This includes the gender, age and location of your target consumers.

- Consumer behaviour: Market research also looks into consumer behaviour. Tracking metrics such as social media engagement rate, product conversion rate, and psychographics/sentiment is a great way to gain insight into what your consumers want from you.

- Market trends: It’s also important to track trends that may impact consumer behaviour. This can be done via social listening and using a media monitoring tool to see what topics are dominating buying and selling trends.

Read 6 Reasons Why You Should Use Media Monitoring

3. Research Strategies

Once you’ve figured out which metrics to use, it’s time to apply that to an analysis model. Here are the different industry and market-specific research strategies that will help enhance your position as a business.

Industry Research Stratgies

There are plenty of research models that allow brands to find out more about their industry. However, the most popular are a SWOT analysis, competitive forces model and a broad factor analysis.

Most businesses start with a SWOT analysis, also known as a model based on strengths, weaknesses, opportunities and threats. This research strategy consists of evaluating your internal performance first to establish your current position in your industry before you complete a competitor analysis.

Once a SWOT analysis is completed, many move on to more complex industry research, such as a broad factor analysis or a competitive forces model. A broad factor analysis applies broad outer-industry components like economic and political factors to your industry and suggests how they may affect success, while a competitive forces model focuses on industry demand and potential competitive opportunities.

Market Research Strategies

Market research models are more well-known by businesses just beginning their research journey.

They consist of customer research methods such as social listening and engagement monitoring as well as competitive business and product research which informs a company on competitor strengthas and weaknesses when it comes to conversion success.

Two models usually associated with market research are market mapping and competitive analysis. Market mapping is ideal for those new to their industry as it consists of mapping competitors and competing products on a positioning map. It’s a great way to find out exactly where you stand in comparison.

Competitive analysis is the most popular form of market research and can be applied to any channel, platform or nice. Simply identify your key selling competition and delve into their content strategy, consumer sentiment and platform performance. Competitor analysis is completely personal and can cover a wide range of metrics, or a strong focus on a partocualr area your aiming to improve.

Which Methodology Is Best For Your Business?

When it comes to benchmarking your business, both an induserty and market analysis are important.

“To thrive in a rapidly changing landscape, businesses must closely monitor customer sentiment by leveraging comprehensive data gathered from a centralized hub of market research tools, methodologies and intelligent processes that are designed to deliver actionable insights from a single source of truth,” says Rick Kelly, Chief Strategy Officer at Fuel Cycle.

Our advice for those just starting out would be to first conduct an industry analysis to determine your potential opportunities and threats as a startup. Once you’ve found a gap in the industry, it’s time to find a gap in the market. This is where market research comes in. Ensure that you know your target consumers inside and out before you drop your first products and services.