Your product/service is perfect. The narrative around it even better. Marketing processes well-researched and super effective. Team – the best.

Still, you’re not selling as much as you’ve planned.

What could have possibly gone wrong?

If you’re looking for the “why”, competitive gap analysis might just be the key to understanding what happened.

💡 Read: Competitive Analysis: All You Need to Know

It is the process of comparing the results you’ve gained with the ones you were expected to get, all while taking your competitors into account. Ultimately, it closes the gap between your and your competitors’ products or services, making your offer the most compelling in the market.

In this blog, we’ll cover:

- Key components of a competitive gap analysis

- How can a media monitoring tool help you in the process

- Why is it important for your business

How to Do a Competitive Gap Analysis

1. Determine your market position

Understanding where you stand in the market involves two key aspects. The first step is to try and evaluate your market share, and the second involves understanding customer preferences.

Evaluating market share

If you’d like a graphic presentation of a market share, think of it as your slice of the business pie. And it’s not just about how much you sell but how much of the entire market you capture, meaning how much you’re talked about.

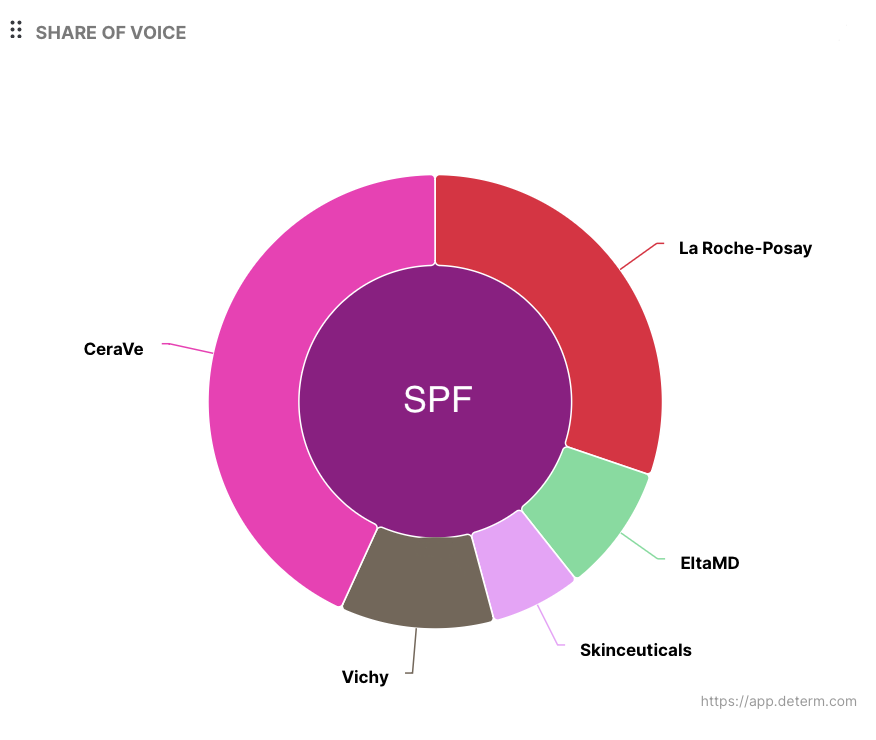

So one of the best ways to grasp your market share is to take a look at the share of voice graph within your media monitoring software. This type of software tracks all online sources and extracts all contexts where your desired keyword (your brand name, product name, campaign name, etc.) was mentioned and provides an analysis.

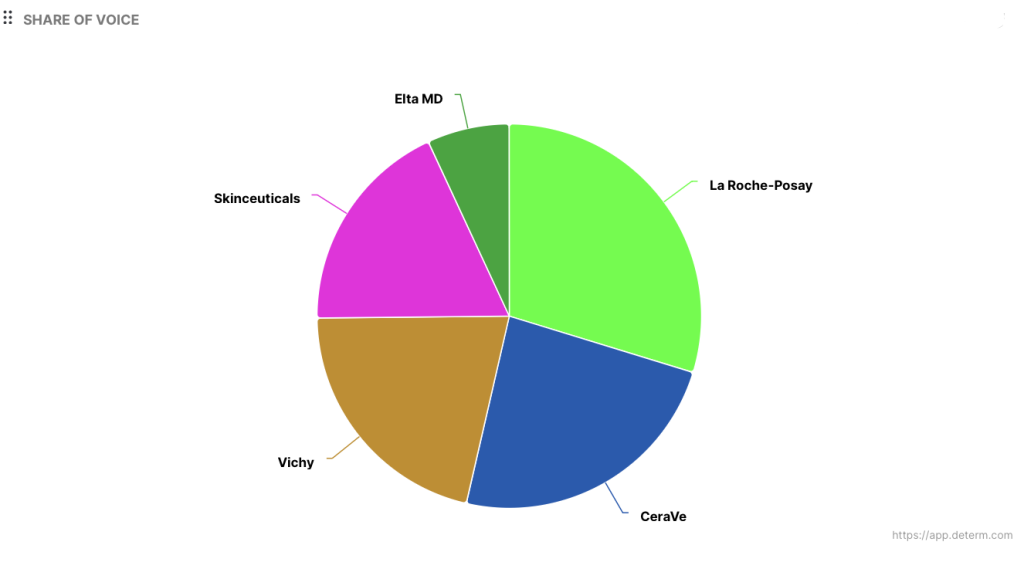

This means that you can get access to data revealing how your brand is perceived, on which channels it is mentioned the most and see easily if you’re missing out on something. This is usually called the share of voice. So if you’re for example, a skincare brand, and you’d like to see how you stand against your competitors in the market, your share of voice chart could look something like this:

Based on this simple setup, it seems that the brand La Roche-Posay holds the largest market share when it comes to brand mentions, meaning it is mentioned the most. But you can go into more detail and segment the data based on other data, like channels, topics, sentiment, influencers, etc.

Read How to Use Social Listening For Market Research

Understanding customer preferences

Your customers hold the key to your success. Knowing what they want, need, and prefer is like having a treasure map. And you can easily get it through a media monitoring tool.

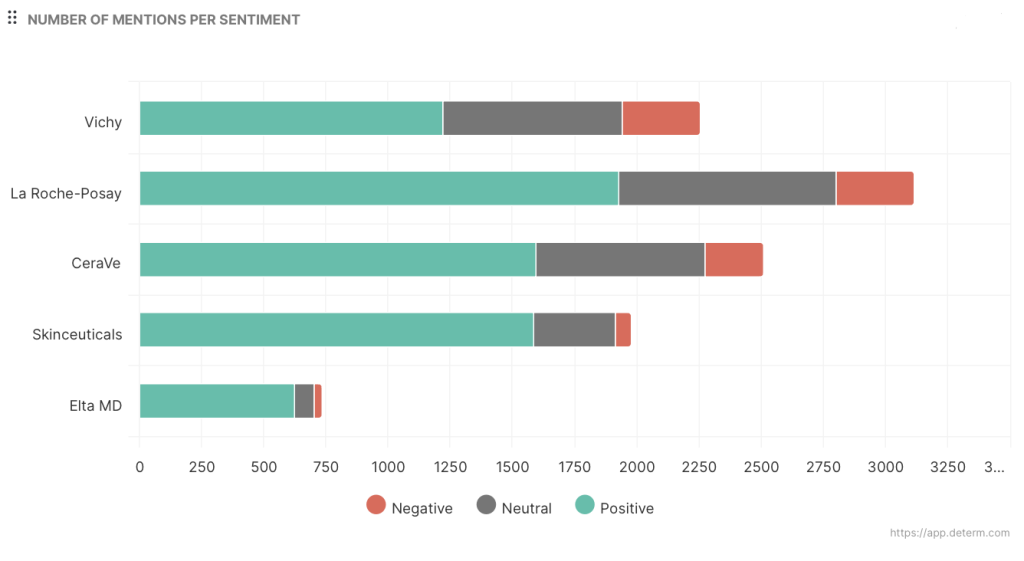

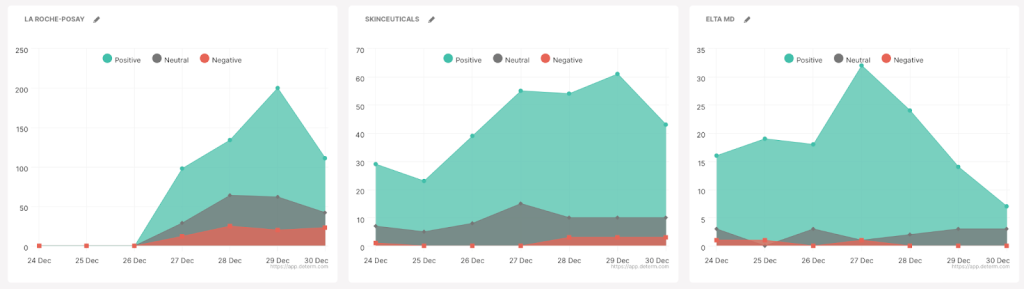

One of the easiest ways to detect your customers’ mood is by using sentiment analysis. It is a process of detecting a positive, negative, or neutral stand towards a certain brand, product, trend, etc. So, again, if you’re, for example, a skincare brand interested in how your competitors are perceived, you can easily compare the sentiment of each of these brands through a media monitoring tool and get a great starting point for your research.

You can even go into more detail and check the negative mentions, what they’re about, and maybe learn from your competitors’ mistakes.

When you master your market position, you gain insights that can shape your strategies. Whether it’s expanding your market share or aligning your offerings with customer desires, these insights become the compass guiding your business forward.

Read How to Conduct a B2B Competitive Analysis

2. Inspect your product/service offerings

Your product/service is always the best. From your point of view.

But is it really?

One of the fundamental parts of a competitive gap analysis is to take a deeper dive into your product/service offerings. The easiest way to do it is to do a detailed SWOT analysis.

Analyzing strengths and weaknesses

Every product or service has its strengths – those features that make it shine. Equally, there may be weaknesses that need attention. List all of these, including opportunities and threats.

What sets your offerings apart? Where can improvements be made? What can endanger your success? Understanding these aspects is the first step toward optimization.

3. Asses your marketing strategies

Do your marketing efforts hit the mark? And most importantly, do they work better than your competitors’?

You don’t have access to their metrics, of course. But there is a workaround that enables you to benchmark your campaigns against your competitors’.

Read 6 Steps To Build a Brand Marketing Strategy [+Examples]

Effectiveness of Current Marketing Efforts

Apart from analyzing key performance indicators (KPIs), such as reach, engagement, and conversion rates, you can easily track the effectiveness of your campaigns with additional metrics and charts through media monitoring. These are, for example, sentiment analysis, influencers, share of voice, word cloud, etc.

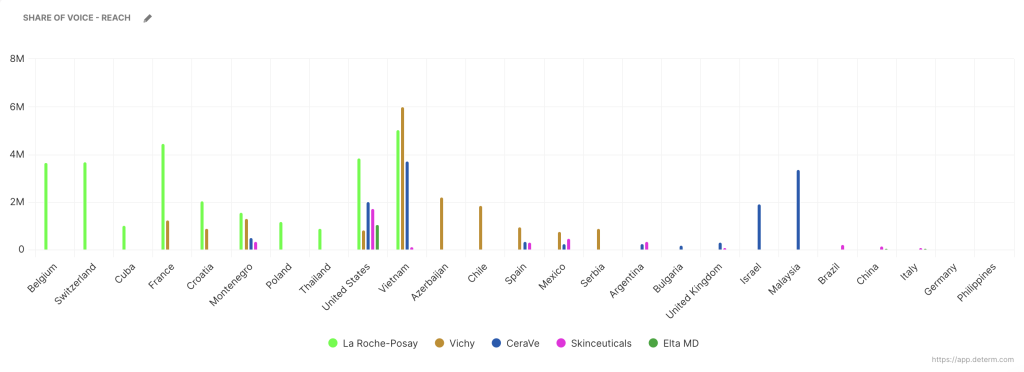

In this way, you can easily see if the wider public likes/dislikes your campaign, which media share the news of your campaign, and just how influential they are, if it had an impact on the overall share of voice when compared to your competitors and which words were mostly mentioned in the same context. You can even see in which markets your competitors have a higher reach than you, like in this example:

This leads us to the next point – it opens a range of opportunities for learning and improvement.

Identifying Opportunities for Improvement

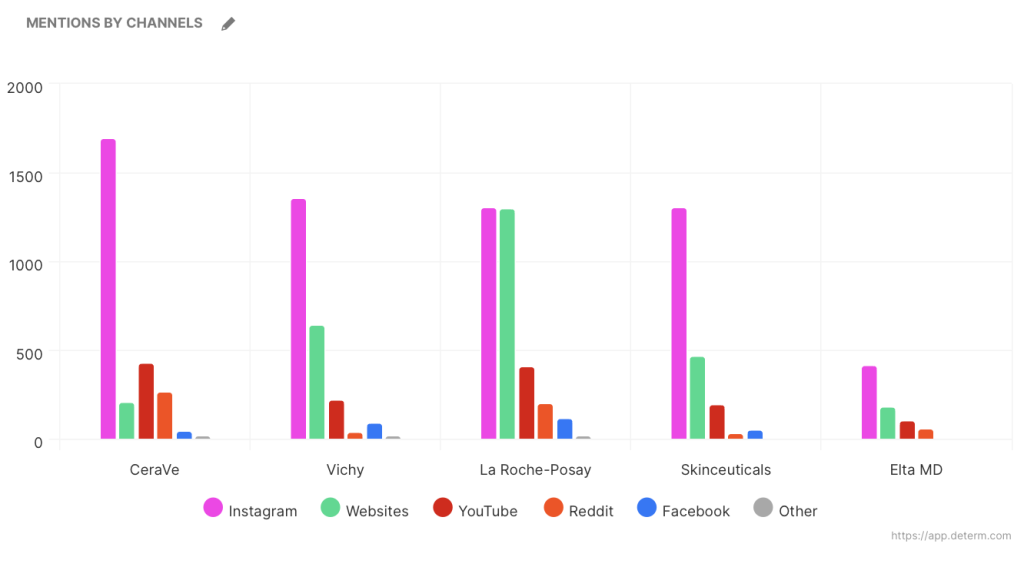

The best part about taking media monitoring metrics and options into account is that you can check all of these for your competitors as well. This gives you the opportunity to detect areas of improvement. So if we go back to the example of skincare brands, you can easily see which brands invest the most in which channels and compare.

The first step would be to divide their channels into earned and owned and then start tracking. This means that you’ll track all mentions coming from channels your competitors don’t control separately from their own social media accounts and websites. This will give you a clearer perspective of how much effort these brands invest into which channel.

Read The Advantages of Competitor Analysis in Today’s Market

Here we can see that for all of them, Instagram is a really powerful channel, but also that some use YouTube and Facebook more than others. If you compare these charts with other ones like share of voice, you can easily conclude which strategies work for them and which don’t.

Read 6 Free Competitor Analysis Templates for Small Businesses

4. Measure customer satisfaction

The heartbeat of a successful business is the satisfaction of its customers. And you nurture customer satisfaction by actively gathering and analyzing feedback and then translating those insights into improvements.

Gathering and analyzing customer feedback

Your customers are your best advisors. And it’s easy when they comment on your social media posts and owned channels. But what happens when it’s on channels that you can’t control, like different forums, review pages, etc.?

This is where sentiment analysis within a media monitoring tool plays a significant role.

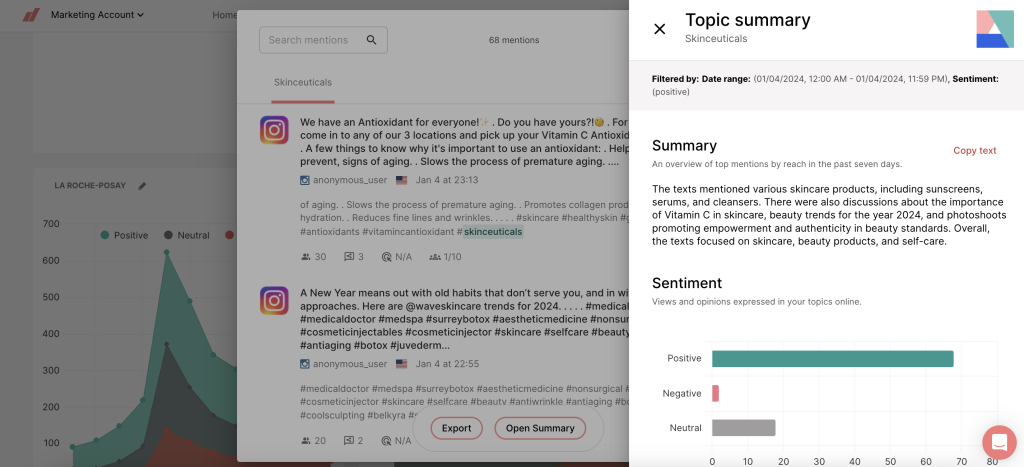

It allows you to observe how the sentiment towards your brand changes and pinpoint when and why specific changes happened.

Read Top 5 Benefits of Sentiment Analysis for Businesses

In Determ, you can even click on spikes within the charts and get an AI-powered summary of all the mentions on that day, which can speed up your process of figuring out why these spikes happened.

Analyze feedback patterns. What aspects of your product or service resonate positively with customers? Are there pain points or areas that need attention?

5. Track industry trends

When you’re working on a new product or service, releasing it is always frightening. The release can be anything from a huge success to a complete disaster. So it’s always important to listen to the industry and try to incorporate best practices to increase your chances of hitting the first scenario.

Let’s say you’d like to release a new skincare product containing SPF. You can use a media monitoring tool like Determ, to track all mentions of your competitors alongside SPF and see which are mentioned the most. Your share of voice chart can look something like this:

This will lead us to a conclusion that CeraVe is the leader in the market when it comes to SPF products, and we might want to take a look at ow they’re communicating it to learn something about it.

Read 3 Easy Ways to Monitor Competitors in Your Industry

In The End

Competitive gap analysis is important for a business for several reasons:

- helps make strategic decisions

- identifies opportunities

- helps mitigate risk

- assesses performance

- enables customer-centric approach

- ensures continuos improvement

It equips businesses to adapt, innovate, and thrive. Armed with insights, your business stands ready for continuous growth.

If you’d like to learn more about using media monitoring to perform a competitive gap analysis, book a demo with one of our experts and let us help you.